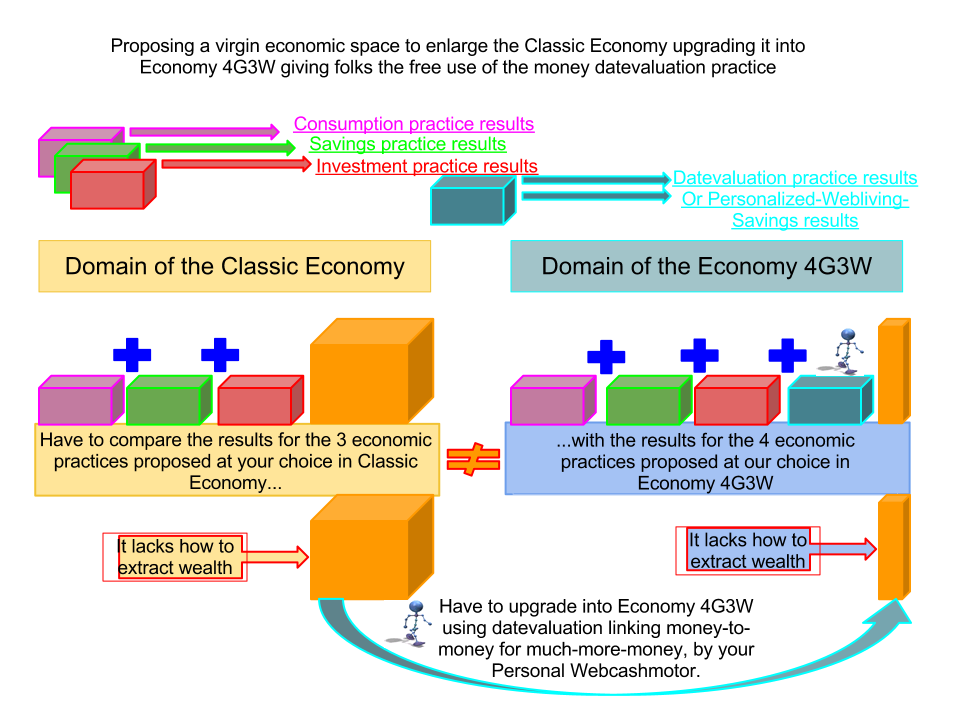

Economy 4G3W is an upgraded version of the Classic Economy that includes the new practice of money data-valuation. This practice allows individuals to produce capital gains risk-free without having to invest in traditional means of production. The aim of money data-valuation is to provide an alternative way to reach capital gains while enjoying the capacity to multiply money without gaming.

This upgraded economy provides individuals with new capabilities to compound personal economic mixes, increasing performance and freedom. However, there are substantial differences between the two economic practices: investment and data-valuation.

In the investment practice, the agent has to buy means of production and accept the abandonment of the cash phase while taking risks of loss. On the other hand, in the data-valuation practice, the agent only needs to allocate money into a sovereign anchor for sharing cash production. They get the right to share cash results and can reverse the action at any time without any costs.

In the investment practice, the agent has to implement a long cycle of production composed of many steps with permanent guidance and revision needs. In contrast, in the data-valuation practice, the agent only needs to implement a short cycle of production composed of cash sharing-cash-production for direct cash sharing cash results.

Another difference between the two practices is that in the investment practice, the production is not proportional to the amount invested. In contrast, in the data-valuation practice, the production is proportional to the amount allocated and does not need to be invoiced or cashiered.

Finally, in the investment practice, the effect of time going is towards lower performances. In contrast, in the data-valuation practice, the effect of time going is towards higher performances. Overall, these differences allow individuals to choose the practice that best suits their needs and goals.